Waiting to Buy a Home?

You May Miss Out on Low Interest Rates

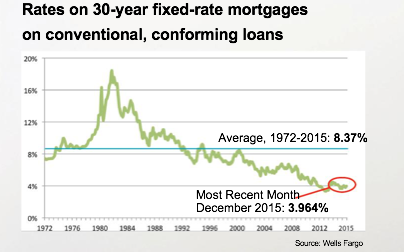

In December, the Federal Reserve raised the key interest rate by a quarter-point to a range of 0.25% to 0.5%, the first rate increase in nearly a decade. While some experts expect the Fed to raise rates gradually this year, some economists expect rates to increase three or four more times this year. Increases are anticipated to amount to a quarter-point each time, and when they do occur are sure to impact mortgage rates. What’s a homebuyer to do?

NOW IS THE TIME TO BUY!

- While a quarter-point increase in interest rates doesn’t seem like much, it could mean the difference of hundreds of dollars a month in your mortgage payment, depending on the price of the home, your interest rate, how much you’re borrowing and the size of your down payment. This is money you could use to renovate, go on vacation or save for retirement.

WHAT SHOULD YOU DO NOW?

- Get pre-qualified for a mortgage if you haven’t done so already.Getting pre-qualified means you can spring into action when you find the home you want to buy. I work with great lenders in our area. If you’re looking for a lender you can trust, let me know and I’d be happy to connect you with someone from my network.

- Narrow down your search criteria. What neighborhoods do you have your eye on? Do you want three or four bedrooms? Do you want a big yard or no yard at all? This list goes on and on. While buying a house is a process of elimination, not a process of selection, the more you know what you want, the better prepared you are to make the right decision.

- Get hunting. If you’ve been passively house hunting online, now is the time to ramp up your search. Let me know what you’re looking for and I’ll work with you to find a great home that meets your criteria.

Don’t wait for another rate increase to buy. Call/text/e-mail me today to discuss the home buying process and your options within our local real estate market!